LOS ANGELES, CA — Hadley, a new app seeking to make it easy and social to save for school and career training costs, announced today its official launch after a successful beta period. The app, named after Founder and CEO Yosh Miller’s niece, simplifies finding and funding 529 savings accounts, helping others plan for future education and career training expenses without any advisory or monthly subscription fees.

Hadley breaks down systemic barriers that blocked people from starting 529 accounts sooner. Traditionally, parents are the main contributors to their 529 plans and wait on average until their children are seven years old before setting up an account due to the reality that many families face immediate financial needs like daycare and doctor visits that make long-term saving for education more difficult. Now, families can open and link their 529 accounts to Hadley for free, even before their child is born, so others can contribute to it – allowing families to take full advantage of the power of tax-free compounded growth. In turn, Hadley helps families to start saving more, sooner.

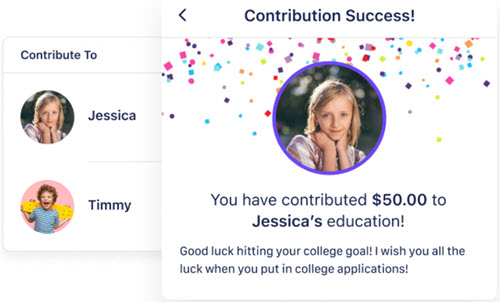

Miller, a former Deloitte Strategy and Operations consultant for government agencies and strategy executive for MRC Entertainment, created Hadley to address families’ challenges when planning and saving for education. One of Hadley’s most impactful features allows family members and friends to contribute to a 529 plan, even if they don’t directly own the account. App users can quickly link their new or existing 529 plans to their Hadley account, making it easy for others to contribute to a child’s or adult’s education. App users can make one-time gifts or set up recurring contributions to their own or others’ accounts. Hadley works with all 529 Plans, 529 Advisor Plans, and 529 ABLE Plans.

“As student debt skyrockets, I want to help families save for school the same way I help my own family,” said Yosh Miller, Founder and CEO of Hadley, an SEC-Registered Investment Advisor. “Most 529 plans have high fees and poor ratings. Hadley helps Americans find and fund top-rated savings accounts. Most families experience difficulty self-funding their own accounts, and some 529 Plans lack a gifting feature altogether. Hadley solves for this and works with all 529 Plans — even those without a gifting portal, making it easy to contribute to others’ education savings. Every little contribution can go a long way, especially when it grows compounded tax-free, year after year. These contributions can really add up over time.”

A 529 is a tax-advantaged savings plan designed to set aside funds for future education and technical / trade career training expenses. The app matches users to the 529 plan that aligns with their personal savings style and maximizes their federal and state tax benefits at no cost to users. As Miller describes, Hadley is a “savings hack” that matches users to 529 Plans, similar to how people use Kayak to find their best flight option. Families can start their Hadley account for free. Users only pay a nominal transaction fee per contribution, ranging from $1.49 for contributions under $150 to a $20 cap for contributions over $2,000.

In addition to simplifying the research and setup process for 529 accounts, Hadley educates users that money in a 529 is flexible and can be used across different expenses and transferred among family members. From tuition, room and board to computers and off-campus housing, 529 plans cover various education-related expenses, including private K-12, grad school, and even student loan repayments. Users can transfer funds unlimited times among current and future family members, penalty and tax-free. Leftover 529 funds can now rollover to Roth IRA accounts, also tax-free. Whereas Roth IRAs have income limits, 529s have no income or age restrictions, making 529 plans an attractive vehicle that most Americans do not know exists.

“As we launch nationally, we’re excited to introduce Hadley to communities across America,” Miller concluded. “Our mission is to help families and fellow Americans save for their best futures. With Hadley, we’re making that process a whole lot easier.”

Hadley fills a crucial need in an economy where skilled labor shortages are widespread and higher education and technical career training are increasingly necessary yet continue to grow prohibitively more expensive. Hadley not only aids in bridging the financial gap but also takes a step toward democratizing education. The app helps empower families to make informed financial decisions and optimize the value of their contributions, paving the way for a brighter future without the burden of extensive loans. Miller is passionate about democratizing access to college and career training savings. Miller adds, “I firmly believe we all win when we prioritize the future and support others in pursuing their top-choice postsecondary paths. Our society already feels the effects of shortages of nurses, teachers and electricians in our neighborhoods, just to name a few. Having a 529 plan isn’t just money in an account — it helps move the needle for our country in reaching our best collective future together.”

Hadley is available on iOS and Android.

For more information, visit www.gohadley.com.

About Hadley

Hadley is an innovative app designed to simplify the process of setting up and funding 529 education savings plans. Named after the niece of CEO Yosh Miller, Hadley provides a humanized, efficient, and free way for families to plan for their educational futures. Through the app, users can identify their ideal 529 plan, link their plan to their account for easy contribution, and learn more about the broad uses of 529 funds. By simplifying and demystifying the 529 processes, Hadley is democratizing education savings and helping families build their best futures.

Disclosure

The preceding should not be interpreted as investment advice. This is not a recommendation to buy, sell, hold, or invest in any particular security or instrument. Past performance does not guarantee future results.