Comprehensive report details state progress (or lack of) in teaching finance and economics in K-12

In the midst of the country’s slow climb to economic recovery, there’s been an outpouring of support from communities to teach today’s students the one subject that could perhaps prevent future economic woes: personal finance and economics. However, though states are making progress, there’s still work to be done.

In the midst of the country’s slow climb to economic recovery, there’s been an outpouring of support from communities to teach today’s students the one subject that could perhaps prevent future economic woes: personal finance and economics. However, though states are making progress, there’s still work to be done.

“The number one problem in today’s generation and economy is the lack of financial literacy,” said Alan Greenspan, economist and former chairman of the Federal Reserve.

And the Council for Economic Education (CEE) agrees. The CEE’s report, “Survey of the States: Economic and Personal Finance Education in Our Nation’s Schools 2014,” conducted every two years by the CEE and collects data from all 50 states and the District of Columbia, highlights the best and worst states for teaching personal finance literacy. It also reveals some startling facts about student struggling with finance.

For example, a majority of the public school students in the U.S. still are not exposed to economics or personal finance education despite the lessons of the recent recession. Only 22 of the 50 states require high school students to take an economics course and only 16 states require testing of economics concepts, the survey found. Two years ago when a similar survey was taken, the totals were the same.

Also, 30 percent of college students with loans drop out without having completed their degree, found the CEE, yet only 17 states require a high school course in personal finance.

While only 17 states require high school students to take a personal finance course and only six require testing of personal finance concepts, there has been some growth since 2011 when the totals were 13 and six, notes the report.

“The Great Recession put a spotlight on the dangers of a financially illiterate society, demonstrating the importance of a basic understanding of economic and financial concepts,” said Nan Morrison, the president and CEO of the CEE, in a statement. “We’ve got to do a better job of helping our policy makers and educators ensure that students nearing adulthood gain that understanding.”

(Next page: The best and worst states for finance education)

The best and worst states for finance education

“Students with some exposure to economic thinking will be more likely to conceptualize their spending on postsecondary education as an investment in their own human capital,” said Ben Bernanke, chairman of the Federal Reserve, at the August teacher town hall.

Understanding the importance of finance literacy, especially considering the report found that “students from states where a financial education course was required were more likely to display positive financial behaviors and dispositions,” many states require student testing in personal finance education. These states include: Texas, Georgia, Missouri, Michigan, Colorado, and the District of Columbia.

All six states (includes D.C.) include personal finance education in their K-12 standards and these standards are then implemented throughout all school districts. All states require student testing in this subject as well.

Georgia, Missouri, and Texas are especially noteworthy, as these three states also require a high school course to be offered and require all students to complete this course.

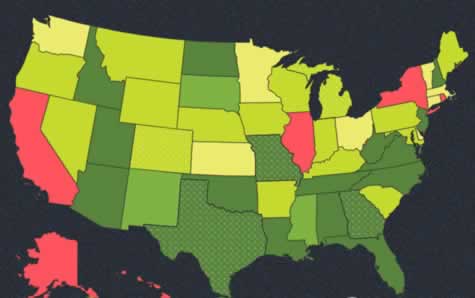

However, California, Illinois, New York, Rhode Island, and Alaska not only do not require testing on personal finance, no courses are offered and no standards on personal finance literacy are currently implemented.

Snapshot of the best and worst states for personal finance literacy. See the full map here.

“The 17 states that require a personal finance course today represent only about 40 percent of the U.S. population,” said Morrison. “That’s a huge gap and we need to close it. We must expand our high school curricula and then provide our teachers with the tools they need to help students develop these essential real-world skills.”

(Next page: Recommendations and teacher confidence)

According to the report, one of the biggest reasons why personal finance courses aren’t implemented is due to teacher hesitancy.

The CEE notes that “fewer than 20 percent of teachers report feeling competent to teach personal finance topics.”

To help students reach financial literacy goals, CEE promotes the Consumer Financial Protection Bureau’s (CFPB) “5 Essential Strategies for Advancing Financial Education for Young Americans”:

1. Introduce key financial education concepts early and continue to build on that foundation consistently through the K-12 school years. In addition, states should make a stand-along financial education course a graduation requirement for high school students.

2. Include personal financial management questions in standardized tests.

3. Provide opportunities throughout the K-12 years to practice money management through innovative, hands-on learning opportunities.

4. Create consistent opportunities and incentives for teachers to take financial education training with the express intention of teaching financial management to their students.

5. Encourage parents and guardians to discuss money management topics at home and provide them with the tools necessary to have money conversations with their children.

“The day-to-day relevance of economic concepts and financial responsibility will only continue to increase as the world is rapidly transformed by science and technology,” explained Richard Fairbank, founder, chairman, and CEO of Capital One Financial Corporation. “Providing students with the practical tools they need to apply that knowledge will help them succeed financially by creating businesses, driving innovation and achieving personal dreams. Working together, we can infuse our classrooms with the necessary foundational capabilities and make financial education a centerpiece of our public and private agenda.”

For more information on individual states and financial and economic curriculum, as well as resources for teachers (lesson plans, online games, and national competitions) and for policy makers (advocacy toolkit, policy roadmap, and state contacts), visit the report’s home page and read the report.

- #4: 25 education trends for 2018 - December 26, 2018

- Video of the Week: Dealing with digital distraction in the classroom - February 23, 2018

- Secrets from the library lines: 5 ways schools can boost digital engagement - January 2, 2018